lexington ky county property taxes

Lexington KY 40507 TEL. Nonresidents who work in Lexington Fayette Urban County also pay a local income tax of 225 the same as the local income tax paid by residents.

Property Valuation Notices Mailed Across Fayette County Ky Lexington Herald Leader

Our Property Tax Division is located in Room 236 on the second floor of the Fayette District Courthouse at 150 North.

. 089 of home value. Get Record Information From 2021 About Any County Property. Find Lexington residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records more.

There are three primary steps in taxing property ie formulating levy rates appraising property market values and collecting payments. Limestone Ste 265 Lexington KY 40507 Tel. The assessment of property setting property tax rates and the billing and collection process.

Each year the County Clerks Office is responsible for conducting a tax sale on the delinquent tax bills. The Assessors Office must keep track of any changes in the 127000 parcels in Lexington County. Type Any Name Search Risk-Free.

Their phone number is 859 254-4941. Different local officials are also involved and the proper office to contact in each stage of the property tax cycle will be identified. Mayor Jim Gray today opened a new payment office to make it more convenient for.

Additionally you will find links to contact information. Apr 24 2017 1054 am. Property Tax Search - Tax Year 2021.

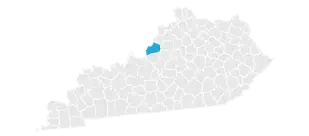

Lexington County explicitly disclaims any representations and warranties including without. The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200. In accordance with Kentucky Revised Statute KRS 132220 the listing period for real property is January 1 through March 1However a taxpayer does not have to list his or her real property if it was described completely and correctly on the previous years tax roll and there have been no significant changes to the property to report for the current year.

Tax amount varies by county. The median property tax in Kentucky is 84300 per year072 of a propertys assesed fair market value as property tax per year. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Limestone Ste 265 Lexington KY 40507 Tel. Property Tax Search - Tax Year 2018. It also adds and values new properties and conducts a reassessment of all properties every five years.

Taxing units include Lexington county governments and numerous special districts like public hospitals. During the tax sale the delinquent tax bills are eligible to be purchased by a third party. Yearly median tax in Fayette County.

The primary duties of the Assessors Office are to inventory all real estate parcels maintain the property tax mapping system and maintain property ownership records. Fayette County collects on average 089 of a propertys assessed fair market value as property tax. 2019 Tax Rate - Real Property 278 per 100 2019 Revenue Potential - Real Property 139000 2019 Tax Rate - Personal Property 30 per 100 2020 Total Taxable Assessment 65000000 2020 Total Real Property Assessment 54000000 2020 Net New Property.

Payment posting may take 2-4 weeks from. Payments may be made in-person at the Office of the Fayette County Sheriff. Lexington County implemented a countywide reassessment in 2015.

On April 18 2022 the Fayette County Sheriff will turn over the unpaid tax bills to the County Clerks Office. Ad Find Lexington County Online Property Taxes Info From 2021. 859-252-1771 Fax 859-259-0973.

To use this search you must provide the Last Name of the primary owner of the vehicle and the Vehicle Identification Number VIN. 859-252-1771 Fax 859-259-0973. Various sections will be devoted to major topics such as.

Kentucky is ranked 880th of the 3143 counties in the United States in order of. Uncover Available Property Tax Data By Searching Any Address. Fast Easy Access To Millions Of Records.

Property Taxes Frequently Asked Questions. Kentuckys median income is 50545 per year so the. Property Taxes No Mortgage 43540100.

Residents of Lexington Fayette Urban County pay a flat county income tax of 225 on earned income in addition to the Kentucky income tax and the Federal income tax. Receipts are then dispensed to associated entities as predetermined. Property Taxes Mortgage 106970500.

Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving customer service efficiency. For any taxpayers property that is assessed by the Department of Revenue and any Fee in Lieu of tax property the Others box needs to be searched using the taxpayers name. This is on the fifth or sixth line down from the perforation depending on the type of property being taxed.

Ad See Anyones Public Records All States. Perform a free Lexington KY public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

The department analyzed researched and processed 12358 deeds in 2014 along with tracking changes to the 22680 mobile homes registered with the County. The reader should not rely on the data provided herein for any reason. Fayette County Property Tax Collections Total Fayette County Kentucky.

New LexServ office serves citizens. It is on the left side of the line that has the Pay This Amount in bold type on the right side of the line. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky.

The due date for payment is shown in bold type on the tear off portion at the bottom of the front of the bill.

918 Commanche Drive Property Real Estate Patio

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

Kentucky League Of Cities Infocentral

Kentucky Property Taxes By County 2022

Kentucky Property Tax Calculator Smartasset

Video Artist Retreat Passive Solar House Pond Multigenerational Horse Property Appalachian Berea Ky Passive Solar Homes Solar House Passive Solar House Plans

Shelby County Tennessee 1888 Map

Welcome 300 At The Circle Luxury Apartment Living Lexington Kentucky Apartment Marketing Marketing Property Management

Business Purchase Agreement Template 19 Judgment That Will Wow You

Tax Relief Intended To Save Kentucky Farms Helps Pave Them Instead Lexington Herald Leader

Kentucky Usda Rural Housing Loans Winchester Kentucky Usda Rural Housing Map For Eli Kentucky Map Rural

76 Sunnyside Drive Nicholasville Ky 40356 For Sale Re Max Http Www Remax Com Realestatehomesforsale 76 Sunnyside Drive Nichol Sunnyside Remax Home Buying

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader